In today’s Grand Strand market, many sellers worry that offering closing-cost help or rate buydowns will “give away” money they could keep. In reality, strategic concessions often cost less than a large price cut and help keep your Myrtle Beach listing competitive in a market that’s more balanced than it was a few years ago.

How Today’s Market Sets the Stage

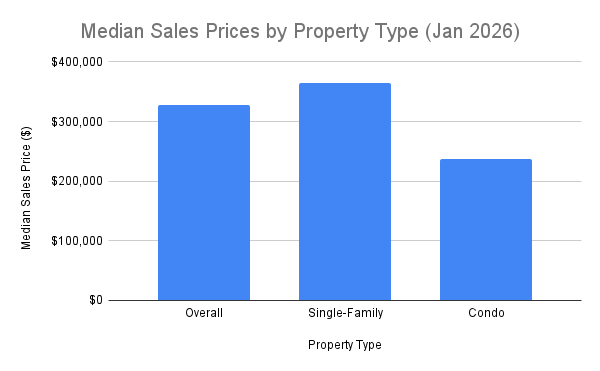

Coastal Carolinas has shifted toward a more normal market, with rising inventory and longer marketing times than the pandemic peak, which means buyers expect more negotiation. Over the 12 months ending January 2026, overall median price across property types was 327,000, with single-family at 365,000 and condos at 238,000. Homes are still holding value, but they are no longer selling instantly, and sellers have rediscovered the importance of pricing and presentation rather than assuming multiple offers above list price.

National NAR data for 2025 show the median seller tenure at an all-time high of 11 years, so most owners have built significant equity and have room to negotiate without going underwater. At the same time, buyers are stretched, as the typical down payment reached 19 percent overall in 2025 and 10 percent for first-time buyers, the highest first-time share since 1989. With affordability strained, helping the buyer with upfront costs can matter more to them than a small discount on price, especially when mortgage rates remain in the 6 percent range.

Sample price vs. concession scenario

List price: 400,000

Option A – 10,000 price cut: new price 390,000; buyer’s monthly payment drops only modestly.

Option B – 7,000 toward closing costs or a rate buydown: price stays at 400,000, buyer brings less cash to closing or locks a lower rate, and your net is only 3,000 different from the larger price cut.

What Buyers Actually Want From Sellers

Nationally, buyers rank affordability and help with upfront costs as major challenges, especially first-time buyers dealing with rent, credit card debt, and student loans. Among buyers who said saving for a down payment was the hardest step, 46 percent cited high rent or an existing mortgage payment, 37 percent mentioned credit card debt, and 36 percent pointed to student loans. Reducing these hurdles with a targeted seller credit can make your Myrtle Beach listing stand out—particularly in price ranges where inventory has grown and buyers have options.

On the seller side, NAR’s 2025 Profile shows that only 27 percent of sellers offered any incentive, but when they did, the most common were assistance with closing costs and home warranty policies. Sellers who used an agent reported achieving a median sales price equal to 99 percent of their final list price, showing that thoughtful pricing and negotiation can keep net proceeds strong even when concessions are involved. In Coastal Carolinas, sellers received an average of 97.1 percent of list price across all properties in the latest 12-month period, with single-family homes at 97.3 percent and condos at 96.0 percent, again not accounting for concessions.

Why concessions resonate with buyers

They reduce cash needed at closing when many buyers are tight on funds.

They can be used for interest-rate buydowns, which improve monthly payment more than a small price cut.

They are flexible: you can target specific repairs, warranties, or HOA fees instead of broad discounts.

The Math: Price Cuts vs. Concessions

Seller concessions and price reductions do not affect your bottom line in the same way, especially in the current Grand Strand price bracket. Overall median price in the Coastal Carolinas is 327,000, and many Horry County sellers are clustered near the 300,000–400,000 range, where buyer affordability is most sensitive. In that band, a 5,000–10,000 concession can meaningfully help a buyer qualify without requiring you to slash your asking price by 20,000–30,000 after weeks on the market.

Median days on market across all price ranges has risen to about 125 days on a rolling 12‑month basis, with condos averaging 132 days and single-family at 123 days. Longer exposure usually leads to bigger price cuts—NAR shows that homes sitting longer see a larger discount from list price—so using concessions early can keep your property from becoming “stale.” In Coastal Carolinas, months of supply is 3.9 for single-family homes and 7.4 for condos as of January 2026, which means condo sellers in particular benefit from tools that differentiate their listing beyond just reducing price.

Example: Same buyer, different structures

Assume a buyer is targeting a 350,000 home in Myrtle Beach:

Scenario 1 – 10,000 price cut: Price becomes 340,000; at a moderate interest rate, this may lower the monthly payment by roughly the cost of one restaurant meal per week.

Scenario 2 – 7,500 seller credit: Price stays at 350,000, but the buyer uses the credit for closing costs or a rate buydown, cutting upfront cash or the payment more than Scenario 1, while your net is only 2,500 different.

Because appraisals in the Grand Strand still support current price levels—median single-family price increased 1.4 percent year over year while overall prices dipped just 0.9 percent—keeping the contract price higher helps preserve your appraised value benchmark for future sales in the neighborhood.

How Concessions Play Out in Myrtle Beach

For Coastal Carolinas, closed sales for single-family homes rose 3.6 percent in 2025, while condo sales declined 3.1 percent, reflecting a split market where some segments are tighter than others. Inventory levels rose 3.1 percent overall in the 12 months through January 2026, with the biggest gains in condos, which now sit at 7.4 months’ supply compared with 3.9 for single-family homes. That extra condo inventory from North Myrtle Beach to Surfside Beach means condo sellers often need to sweeten the deal to compete with similar units in the same buildings and complexes.

Showings data backs up this more selective environment: in 2025, the region logged 194,308 showings with a median of seven showings before a home went under contract, indicating buyers are touring several options before deciding. In Myrtle Beach alone, listings saw 30,809 showings in 2025 and 6,848 showings in January 2026, but buyers have more time and more inventory to compare, especially in popular resort and condo corridors. Concessions like prepaid HOA dues, parking fees, or a home warranty can help your property stand out against similar listings a buyer has already seen.

Sample Myrtle Beach–area concession ideas

Credit toward closing costs instead of cutting list price, especially on condos near the Boardwalk or in North Myrtle Beach towers.

Small rate buydown on a single-family home in Carolina Forest or Conway, where inventory has increased but demand remains steady.

Offering a home warranty in Garden City–Murrells Inlet or Surfside Beach to reduce perceived risk for buyers comparing older homes and newer construction.

This graphic illustrates that single-family homes retain higher median values than condos regionally, which is another reason sellers often prefer keeping price intact and working with concessions at the margin

| Metric | Value |

|---|---|

| Overall median sales price | $327,000 |

| Single-family median sales price | $365,000 |

| Condo median sales price | $238,000 |

| Avg. percent of list price received | 96.9% overall |

| Single-family percent of list price | 97.3% |

| Condo percent of list price | 96.0% |

| Median seller tenure (national, 2025) | 11 years |

| Share of sellers offering incentives | 27% (U.S.) |

Practical Tips for Structuring “Smart” Concessions

For sellers in Myrtle Beach, North Myrtle Beach, and the broader Grand Strand, the goal is to use concessions as a strategic tool, not as a giveaway.

Consider these approaches:

Set a realistic list price based on recent Coastal Carolinas comps, then earmark a capped amount (for example, up to 3 percent of price) for buyer concessions if needed.

Coordinate with the buyer’s lender to see whether a closing-cost credit, permanent rate buydown, or temporary buydown will have the biggest buyer impact per dollar offered.

Tie concessions to repairs or inspection findings so you maintain control over your net while addressing genuine concerns instead of preemptively slashing price.

For condos and townhomes, think creatively: a few months of HOA dues, covering special assessments, or paying for a home warranty can feel more valuable to buyers than the same dollar amount off the price.

In many Myrtle Beach–area transactions, these structures allow sellers to protect their headline price, reduce days on market, and come out ahead compared with the large price reductions that often follow an extended listing.

Carolina Crafted Homes stays current on Myrtle Beach market trends and can answer questions about why concessions cost sellers less than they fear. Reach out anytime for guidance—no pressure, just straightforward expertise.

FAQs

1. What are common seller concessions in Myrtle Beach?

Common seller concessions include closing-cost credits, interest-rate buydowns, home warranties, repair credits, and prepaid HOA dues for condo and townhome buyers. In NAR’s 2025 data, assistance with closing costs and home warranty policies were the top two incentives offered nationally, and those same tools show up frequently in Grand Strand contracts. Local data also highlight longer marketing times for condos, making HOA-related concessions especially useful in buildings along Myrtle Beach, Surfside Beach, and North Myrtle Beach.

2. How do concessions compare to a straight price reduction?

A price reduction lowers the contract price and therefore your gross proceeds, while a concession keeps the price intact and allocates a specific dollar amount to buyer costs like closing fees or rate buydowns. In many Coastal Carolinas scenarios, a 5,000–7,500 concession gives the buyer more help with upfront cash or monthly payments than a 10,000 price cut, yet costs the seller less than the larger discount they might offer after extended days on market. Because appraisals and neighborhood values are tied to contract prices, keeping price stable can also help preserve longer-term value in your community.

3. Do seller concessions hurt appraisals?

Appraisers focus first on contract price and recent comparable sales, and then note concessions to understand the net-to-seller picture. In a market where prices are relatively stable—Coastal Carolinas’ overall median price dipped just 0.9 percent while single-family rose 1.4 percent over the last 12 months—moderate concessions usually fit within normal appraisal parameters when pricing is realistic. Extremely large concessions relative to the price can raise questions, so it is important to align with your agent and, when appropriate, the buyer’s lender before finalizing terms.

4. Are concessions more important for condos than single-family homes on the Grand Strand?

Condos currently face higher inventory and longer months of supply than single-family homes—7.4 months versus 3.9 months as of January 2026—which means condo buyers have more options and more negotiating power. In that environment, targeted concessions such as HOA dues, assessments, or small closing-cost credits can make a specific unit more attractive without forcing a steep price reduction. Single-family sellers in areas like Conway or Carolina Forest can still benefit from concessions, but often face tighter competition and faster absorption than ocean-area condo sellers.

5. How much should I budget for concessions when selling in Myrtle Beach?

Many sellers in the Coastal Carolinas region plan for a concession range of up to 2–3 percent of the contract price, especially in price brackets with more inventory or older properties needing updates. Your agent can look at current Horry County and Georgetown County statistics to see how quickly homes like yours are selling and what typical list-to-sale spreads look like—currently around 97 percent of list price for single-family and 96 percent for condos. Starting with realistic pricing and a defined concession ceiling helps you respond to offers confidently without undermining your net.